The Manila Metro Rail Transit System (MRT-3) snakes through the entire length of Epifanio delos Santos Avenue (EDSA). It hauls an average of 500,000 commuters a day, way more than its capacity of 350,000. Together with the humid Manila climate, the open-air stations, and discourteous passengers, one's rush-hour MRT commute could turn into a harrowing experience.

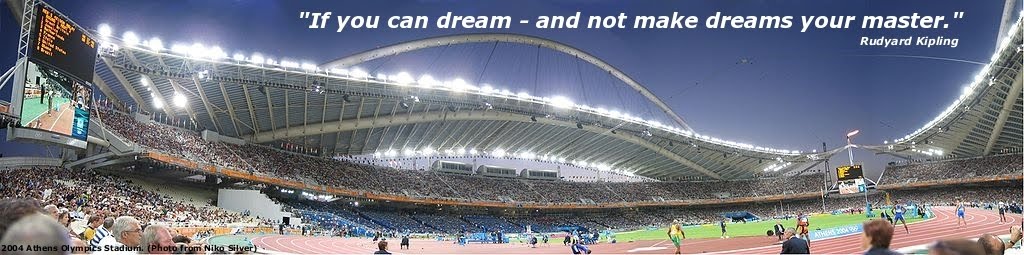

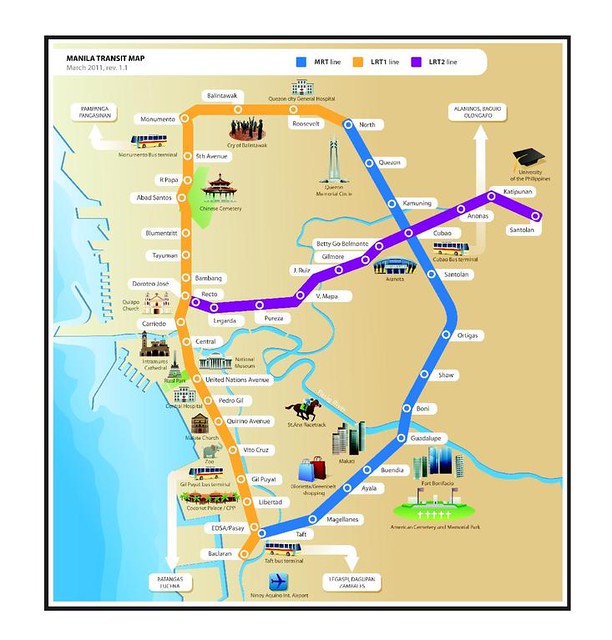

Metro Manila Transportation Map (Photo from Wikimedia)

|

| Photo from Wikipedia |

1.) Be an Early Bird

There's no better way to beat the morning crush by pre-empting its most congested time span. Manila's three central business districts in Ortigas, Bonifacio Global City, and Makati are located south of its most dense population concentrations. Hence, the rush hour action, if we can call it that, is at the southbound direction.

When riding southbound from the North Avenue station, it's best to board the train before 7:00 AM. After this time, the foot traffic increases significantly. Here's a handy tip: enter the North Avenue station at the Trinoma side, instead of the more crowded Southbound gate. MRT management allows passengers who get in at the Trinoma side to pass underneath a series of stairwells right up to the soutbound side.

More importantly, train breakdowns are common occurences. Bear in mind that the MRT-3 has been running over its designed capacity all these years. Not even the most stringent of maintenance routines can prevent the eventuality of overloaded trains conking out!

2.) Purchase a Stored Value Ticket

If you're boarding the train at rush hour, queing to buy a single-journey ticket could eat up half of your travel time. To escape the snaking, slow-moving lines, a Php 100-stored value ticket is the answer. Riding the entire length of the line costs P15. You can use your stored value ticket seven times. Remember that even if your card has only P1 left in value, you get a free ride.

3.) Protect your Valuables

With a sizable chunk of Filipinos living below the poverty line, Manila has its fair share of thieves, scoundrels and scalawags. The crowded confines of the coaches are fertile ground for these pick pockets. It's better to err on the side of caution - and paranoia. Instead of putting your wallet and mobile phone inside your pant pockets, it is best to put those valuables deep inside your bag. If you're wearing a back pack, carry the bag in front of you.

Coaches aren't always this spacious. (Photo from Wikimedia)

And don't forget to put on your street face. It might just help in making you a less likely target.

4.) Bring an Extra Shirt

The

Philippines is a tropical country. For all the advantages a warm

climate offers (i.e. you can't freeze to death, you don't wear several

layers of clothing), living in a place where noon-time temperatures can

reach 36 degrees Celsius in summer can be quite stifling. Since the

coaches are almost always crowded, the commuter should be armed with a

spare shirt.

If you're a salaryman/woman, you might want to neatly fold your work clothes inside your bag. Coming to work in slightly creased clothing is way better than being clad in sweat-drenched business attire.

5.) Park and Ride

The Trinoma mall offers a cost-effect park and ride system for MRT commuters. Riders can park their automobiles at the strategically placed North Avenue carpark building of the mall for a mere P50 flat rate (during weekdays only). Just remember not to go beyond the 2:00 AM cut-off, lest you be charged the overnight parking rate of P150.

Read: "Trinoma Park and Ride"

6.) Box-out5.) Park and Ride

The Trinoma mall offers a cost-effect park and ride system for MRT commuters. Riders can park their automobiles at the strategically placed North Avenue carpark building of the mall for a mere P50 flat rate (during weekdays only). Just remember not to go beyond the 2:00 AM cut-off, lest you be charged the overnight parking rate of P150.

Read: "Trinoma Park and Ride"

During rush hour, Filipino patrons of the MRT could get quite rude. As soon as the train doors slide open, the disembarking passengers are instantly pushed by an onslaught of warm bodies. In the rat race to get home early and fast (and cheap at that!), proper manners are quickly forgotten.

MRT riders aren't always this orderly. (Photo from Wikimedia)

Hence, the alighting passengers (as well as those about to board) should possess decent boxing out technique, especially when disembarking (or boarding) at the most crowded stations (Ayala Station, Shaw Boulevard Station, Quezon Avenue and Cubao). Most Filipino males are no strangers to boxing out. After all, there is a basketball in practically every corner in Metro Manila.

In this day and age of high fuel prices and global warming, taking public transportation is the answer to rid your wallet of gas expense and to do your bit for the environment. The MRT, in spite (or because of) its relatively cheaper fares offer a distinct cost-advantage for the price-conscious Filipino commuter. Despite its inherent ills, one's MRT riding experience need not be stressful.