Government Securities

The Bureau of Treasury awarded last week’s Treasury Bill auction in part, as it rejected all bids of the 91-day tenor. Had the BTr made a full award of the three-month papers, yields would have risen to 2.895%, up 72.1 bps from the previous auction. The 182- and 364-day T-Bills fetched average yields of 2.274% (- 2.6 bps) and 2.45% (- 5 bps), respectively. Total tenders for the P7.5 billion offer amounted to P10.663 billion. The BTr raised P5.5 billion in short-term debt.

The Bureau of Treasury awarded last week’s Treasury Bill auction in part, as it rejected all bids of the 91-day tenor. Had the BTr made a full award of the three-month papers, yields would have risen to 2.895%, up 72.1 bps from the previous auction. The 182- and 364-day T-Bills fetched average yields of 2.274% (- 2.6 bps) and 2.45% (- 5 bps), respectively. Total tenders for the P7.5 billion offer amounted to P10.663 billion. The BTr raised P5.5 billion in short-term debt.

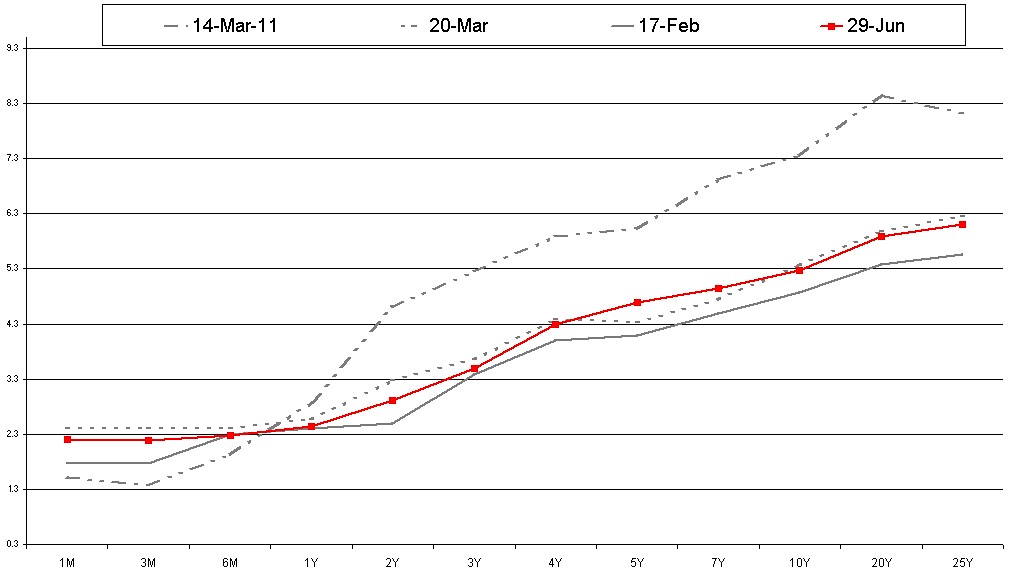

Secondary market yields fell marginally due to half-year window dressing. The (1) release of negligible budget deficit data, despite accelerated government spending, and (2) the smaller volume of 20- and 25-year in the BTr’s 3Q 2012 borrowing program spurred demand, as well. FXTN 20-17 shed 4.5 bps to hit a low of 5.88% on Friday morning, while FXTN 25-8 dipped 8.5 bps to 6.10%.

Total turnover for secondary GS market trades amounted to P81.135 billion last week.

Foreign Exchange

Risk aversion ahead of the European summit saw the Peso retreat by P0.22 against the U.S. Dollar on Monday. From Monday’s close of P42.64, the USD-PHP rate rose to P42.34 on Thursday, gaining P0.30 in three days of trading on better-than-expected U.S. home sales data and U.S. manufacturing data. Improvements in the Euro zone (relaxing of repayment conditions for Spanish loans) enabled the Peso to appreciate by P0.22 to cap the week at P42.12. Total weekly volume for the USD-PHP spot market amounted to $4,589.44 million.

Stock Market

Window dressing, as well as positive leads from the U.S. markets, lifted the PSEi to its highest levels in more than a month’s time. The main index rose from 5,167.20 (+ 47.13) on Monday to 5,257.92 (+ 64.08) on Wednesday. The main index closed slightly lower in the subsequent trading days, as the market took a breather. Concessions by Germany on the repayment conditions on Spanish banks pared losses on Friday, enabling the PSEi to close the week at 5,246.41 (-9.74).

Rates Forecast

June 2012 inflation data, based on the indications and forecasts, are expected to be benign. If it ranges lower than the 2.9% headline inflation in May 2012, yields could again inch down by a few basis points. The results of the Euro summit could prove troublesome, especially if the member nations exhibit disagreement yet again. The end of window dressing could also reduce some of the demand that resulted in marginally lower rates last week.

The 5-year auction – a new issue - this Tuesday could range from 4.625% to 4.75%. The 5-year PDST-F and PDST-R2 on Friday were at 5.1058% and 4.70%, respectively.

Sources: Business World, PDEX, Philippine Daily Inquirer, Bloomberg

Foreign Exchange

Risk aversion ahead of the European summit saw the Peso retreat by P0.22 against the U.S. Dollar on Monday. From Monday’s close of P42.64, the USD-PHP rate rose to P42.34 on Thursday, gaining P0.30 in three days of trading on better-than-expected U.S. home sales data and U.S. manufacturing data. Improvements in the Euro zone (relaxing of repayment conditions for Spanish loans) enabled the Peso to appreciate by P0.22 to cap the week at P42.12. Total weekly volume for the USD-PHP spot market amounted to $4,589.44 million.

Stock Market

Window dressing, as well as positive leads from the U.S. markets, lifted the PSEi to its highest levels in more than a month’s time. The main index rose from 5,167.20 (+ 47.13) on Monday to 5,257.92 (+ 64.08) on Wednesday. The main index closed slightly lower in the subsequent trading days, as the market took a breather. Concessions by Germany on the repayment conditions on Spanish banks pared losses on Friday, enabling the PSEi to close the week at 5,246.41 (-9.74).

Rates Forecast

June 2012 inflation data, based on the indications and forecasts, are expected to be benign. If it ranges lower than the 2.9% headline inflation in May 2012, yields could again inch down by a few basis points. The results of the Euro summit could prove troublesome, especially if the member nations exhibit disagreement yet again. The end of window dressing could also reduce some of the demand that resulted in marginally lower rates last week.

The 5-year auction – a new issue - this Tuesday could range from 4.625% to 4.75%. The 5-year PDST-F and PDST-R2 on Friday were at 5.1058% and 4.70%, respectively.

Sources: Business World, PDEX, Philippine Daily Inquirer, Bloomberg

No comments:

Post a Comment