Government Securities

The Bureau of Treasury awarded last Monday’s Treasury Bill auction in part. The BTr rejected all the bids for the 91-day T-Bills, but made a full award of the 182- and 364-day tenors. There were no major movements in the rates, as the average yields for the 182- and 364-day bills fetched 2.30% (+ 4.2 bps) and 2.50% (- 1.8 bps), respectively. The BTr issued a total of P5.5 billion out of the P7.5 billion offer.

Tired from all the financial terms? Click her to learn more about Lauren Boden, this week's Track Beauty!

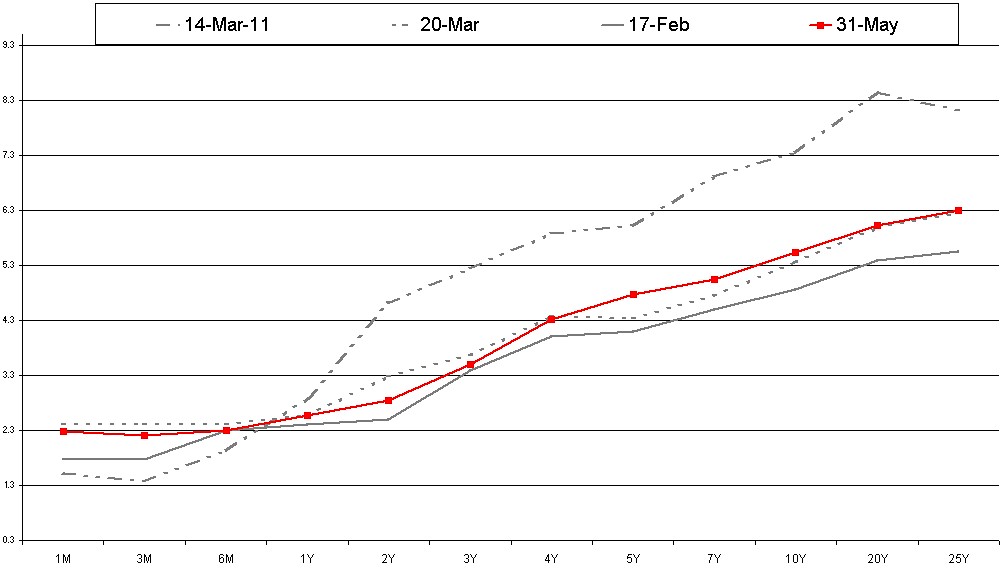

The secondary market traded sideways with an upward bias the entire week. Trading bands were narrow, as market reaction to Moody’s revision to the Philippines’ credit outlook was minimal. The release of better-than-expected 1Q 2012 GDP data spurred some knee-jerk selling, but at the end of the day, changes were minimal. FXTN 20-17 traded between 6.00% - 6.06%, while FXTN 25-8 ranged from 6.15% to 6.20%.

Tired from all the financial terms? Click her to learn more about Lauren Boden, this week's Track Beauty!

The secondary market traded sideways with an upward bias the entire week. Trading bands were narrow, as market reaction to Moody’s revision to the Philippines’ credit outlook was minimal. The release of better-than-expected 1Q 2012 GDP data spurred some knee-jerk selling, but at the end of the day, changes were minimal. FXTN 20-17 traded between 6.00% - 6.06%, while FXTN 25-8 ranged from 6.15% to 6.20%.

Foreign Exchange

The Peso gained against the U.S. Dollar in the first two days of trading, as news of a pro-bailout party leading the Greece polls and a positive revision to Moody’s outlook on the Philippine credit rating boded well for the local currency. The Peso closed at P43.22 (+ 0.32) on Tuesday, gaining a total of P0.535 over the course of two days. However, the local currency retreated by P0.28 (P43.50) against the U.S. Dollar the next day, amidst continued woes in the Spanish banking sector, under performing Australian retail sales and pronouncements of smaller-than-expected Chinese economic stimulus.

The Philippines’ unexpectedly faster 1Q 2012 overshadowed foreign-driven woes. The local currency closed the week at P43.40 (+ 0.10). Total weekly volume of the USD-PHP spot market amounted to $4,964.56 million.

Stock Market

The PSEi went above 5,000 points as the local equities market rebounded amidst developments in the Euro zone. The main index was further bolstered by GDP figures on Thursday, as it closed at 5,091.23 (+ 72.91) from 4,952.74 (+26.77) on Monday. Slower Chinese manufacturing growth, a revision in the US GDP growth data (slower growth), increase in U.S. jobless claims and rising Spanish bond yields soured the global outlook on Friday, as the PSEi retreated by 28.79 points to close the week at 5,062.44. Total weekly volume for stocks in the main index amounted to P36.66 billion.

Rates Forecast

Although indications for the upcoming inflation (5 June), budget deficit (15 June) and monetary policy (14 June) meetings appears supportive of current secondary market rates, barring any unforeseen hitches, the precarious situation in Europe coupled with signals of slowing Chinese growth have dimmed market sentiment. Higher-than-expected GDP figures could drive up some hot money into the country, but then again, flight-to-quality play is rampant, as exhibited by record-low yield of German, French and Austrian government bonds.

Market players could submit high bids in this Tuesday’s 7-year Treasury Bond auction, in light of the paper’s illiquid nature. FXTN 7-53 last fetched 5.02% in the secondary market (18 May). The PDST-F and PDST-R2 rates for the said security were at 5.2767% and 5.072%, respectively, as of last Friday. The BTr might reject all the bids outright, if bids range at the 5.10% level. A 5% to 5.05% range seems plausible.

Sources: Business World, PDEX, Philippine Daily Inquirer, Bloomberg

No comments:

Post a Comment